We acquire and operate enduring service businesses alongside founders and management teams-prioritizing continuity, culture, and long-term value over short-term outcomes.

We buy businesses to operate or to partner with existing leadership to grow them for decades.

Flexible structures, thoughtful transitions, and a buyer who respects what you’ve built.

Backed by experienced investors and operators who help businesses scale responsibly.

We don’t believe there’s one right structure. We’re just as comfortable supporting an existing CEO as we are stepping into operations ourselves.

Collectively, our team has built, scaled, and operated multi-location businesses, led founder-led and venture-backed companies, and executed complex growth and M&A initiatives. We bring an owner’s mindset, not a financial buyer’s playbook.

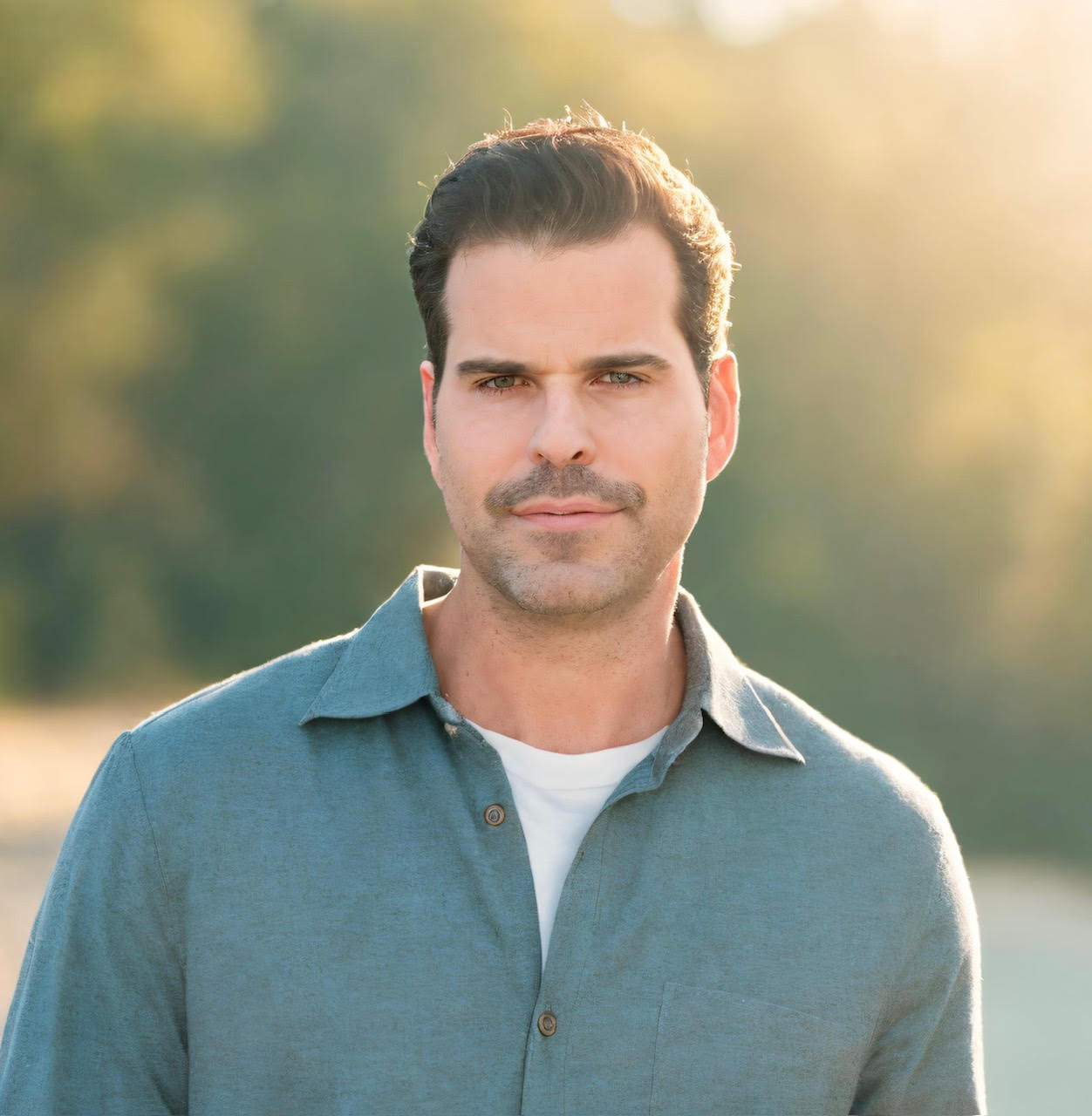

Carl Wolf is a seasoned operator, investor, and consultant with experience in scaling high growth technology companies. He previously held various executive roles, overseeing functions such as marketing, business development and sales, and operations. His commercial experience includes capital raising, licensing, and various deal and partnership structures. He was the Chief Operating Officer LanzaTech, a Chicago based biotech startup that went public in 2023, and was the Chief Commercial and Chief Operating Officer of Newlab, a New York City based venture platform, supporting new company growth and technology commercialization.

Early in his career Carl worked as a management consultant in Washington, DC. Carl holds a BA from the University of Maryland Baltimore County, an MS from New York Institute of Technology, and an MBA from Northwestern University’s Kellogg School of Management.

Currently Carl is an investor, advisor, and mentor to several early stage technology companies and small businesses. He lives in Westchester, New York, with his wife and two children.

Brian Cinelli is an operator and investor with experience building and scaling multi-location operating businesses. He is currently a co-owner and operator of multi-location companies, where he has been directly involved in scaling operations, building management teams, and driving revenue growth initiatives.

Previously, Brian served as a Vice President at Eastcom Associates, a distributor in the underground utility sector, where he led initiatives across product development, sales, and growth strategy. He brings a hands-on operating background and a disciplined, execution-focused approach to sourcing and building platform businesses.

Lucas Gabow is a New York–based entrepreneur and operator with a background in storytelling, media, and high-impact digital growth. He began his career building and scaling digital platforms for founders and creators, helping shape brand narratives that reached millions and translated attention into durable businesses.

More recently, Lucas has moved into hands-on operations and ownership. He is a partner at Protocol Health, a modern longevity clinic, where he is deeply involved in growth strategy, systems, and day-to-day execution. Alongside this work, he actively pursues and operates small businesses with a long-term ownership mindset.

Lucas is driven by a simple philosophy: buy and build businesses the right way-with care for people, respect for legacy, and a commitment to long-term value creation. His goal is to build something lasting, close to home, alongside partners and teams he’s proud to grow with.

Joe Garvey is a seasoned entrepreneur and operator with a track record of building high-performing teams and scaling service businesses across industries. He’s the founder of Protocol Health, a modern longevity clinic in Westchester, NY, and co-founder of Protocol Wellness, which operates multiple locations of the national franchise Pause Studio.

His background spans healthcare, civic tech, media, and politics-including running a $1.9M congressional campaign and co-founding a national nonprofit. Joe brings deep operational chops, growth strategy, and a long-term ownership mindset to every business he touches.

Service-oriented, non-discretionary

Essential businesses with durable demand and pricing power.

U.S. focused, geography flexible

Open to strong regional markets across North America.

$2–5MM EBITDA

Established businesses with institutional scale.

Proven operating history

Typically 10+ years of consistent performance.

Recurring or repeat-driven

Contracts, service agreements, or embedded customer relationships.

Stable earnings

Limited seasonality and diversified customer base.

Long-term relevance

Industries with clear staying power and tailwinds.

Leadership continuity

Strong management team in place post-close.

High-risk profiles

Highly cyclical, heavy CapEx, major turnarounds, or >30% customer concentration.

We know how much care and sacrifice goes into building a great business. Our goal is to honor that legacy, not replace it.

TriPell is built to own businesses for the long term. We’re not a private equity fund chasing a short exit, and we’re not financial engineers. We are hands-on operators who partner with founders and management teams to steward and grow great businesses over decades.

We approach each transaction with flexibility and alignment, focusing on:

For sellers, this means working with a well-capitalized, committed buyer who values continuity, integrity, and long-term value creation-not a quick flip.

TriPell Partners is backed by a group of experienced capital partners and long-term investors who share a common objective: to acquire and build exceptional businesses for long-term ownership.

We invest our own capital alongside our investor partners to acquire controlling interests in high-quality, founder-led businesses. Our capital base consists of family offices, entrepreneurs, and strategic investors who prioritize durable growth, capital preservation, and long-term value creation over short-term financial engineering.

This permanent-capital mindset allows us to move quickly, close with certainty, and structure transactions around what is best for the business, the employees, and the seller.

We are equity investors and business builders. We acquire businesses outright or as majority partners and work closely with management teams to grow and strengthen the company over time.

Our investments focus on:

We do not approach acquisitions as financial trades. Instead, we seek to be long-term stewards of the businesses we acquire, investing in people, systems, and sustainable growth.

We are not brokers, not lenders, and not minority investors. We acquire controlling interests in businesses we intend to own and operate for the long term.

Our investor group includes:

These partners provide both capital and strategic perspective, allowing TriPell to act as a committed, well-resourced owner with the ability to support businesses through multiple stages of growth.

Selling a business is more than a transaction. It’s a handoff of something you’ve spent years building-your people, your reputation, and your legacy.

At TriPell, we’re long-term owners, not short-term flippers. We acquire businesses to operate and grow them for decades, not to repackage them for resale. That means decisions are made with durability, people, and continuity in mind.

We respect what you’ve built. Our goal isn’t to overhaul your business, but to preserve its culture, strengthen what already works, and support the team that made it successful.

We offer flexible, seller-friendly structures and take a hands-on, operator-led approach post-close. With committed capital and a disciplined process, we move efficiently and transparently, so sellers have clarity and certainty every step of the way.

Every founder’s situation is different. We structure transactions to fit the goals of the owner and the needs of the business.

• 100% buyouts

• Majority recapitalizations with meaningful equity rollover

• Structured transitions over time

• Founder stays involved or fully exits-both work

• Growth capital partnerships

We believe the real work begins after the transaction closes. Our approach is designed to create stability, not disruption.

• Management and team remain in place

• Company name, brand, and culture are preserved

• Founder involvement is flexible and tailored

• We invest in systems, people, and growth-not cost cutting

• No flip, no fund pressure, no short-term games

Our goal is to be the last capital partner your business ever needs.

Unlike private equity or financial buyers, TriPell is built for permanent ownership. We are not a fund with a forced exit timeline, and we do not rely on financial engineering to create returns. We buy businesses to operate them — not to repackage and resell them. Our capital stays, our team stays, and our focus remains on building enduring companies with the people who made them successful.

Every founder’s situation is different. We structure transactions to fit the goals of the owner and the needs of the business.

• 100% buyouts

• Majority recapitalizations with meaningful equity rollover

• Structured transitions over time

• Founder stays involved or fully exits — both work

• Growth capital partnerships

We believe the real work begins after the transaction closes. Our approach is designed to create stability, not disruption.

• Management and team remain in place

• Company name, brand, and culture are preserved

• Founder involvement is flexible and tailored

• We invest in systems, people, and growth — not cost cutting

• No flip, no fund pressure, no short-term games

Our goal is to be the last capital partner your business ever needs.

Our process is designed to be straightforward, respectful of your time, and focused on finding the right long-term home for your business.

~$500K (POF available)

SBA 7(a) (SBA Pre-qualified)

Flexible; standard holdback/escrow

Asset purchase, cash-free/debt-free, normalized NWC peg

~$500K (POF available)

SBA 7(a) (SBA Pre-qualified)

Flexible; standard holdback/escrow

Asset purchase, cash-free/debt-free, normalized NWC peg

~$500K (POF available)

SBA 7(a) (SBA Pre-qualified)

Flexible; standard holdback/escrow

Asset purchase, cash-free/debt-free, normalized NWC peg

Experienced operators and strategic investors are guiding our acquisition and growth journey.

COO of Newlab and former COO of LanzaTech, where he helped scale one of the world’s leading carbon recycling companies.

Founding Managing Director at Pardon Family Office. A talent strategist and growth advisor focused on mission-driven operators.

Multi-unit franchisee across Taco Bell, Popeyes, and other brands; former executive at Citi, AIG, and TD Bank.